Who owns who in the

travel industry in 2019?

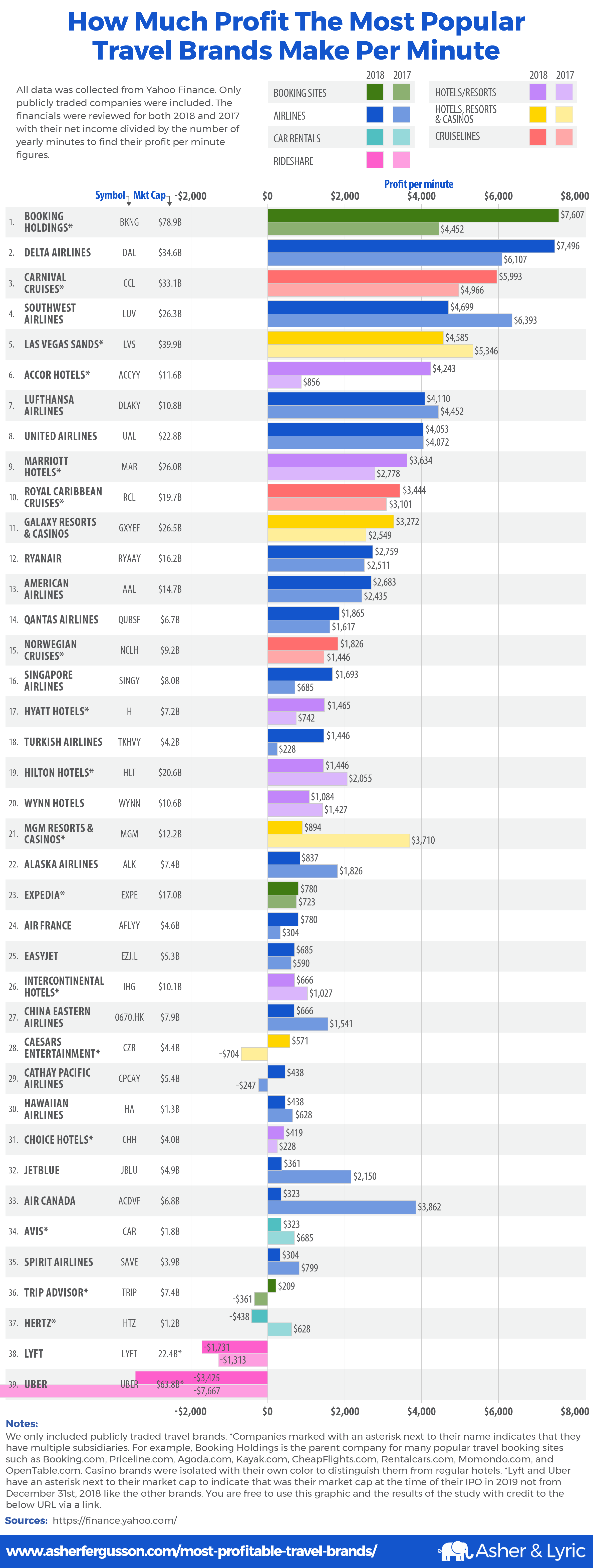

The above list includes 39 of the biggest publicly-traded companies in the tourism industry, including most of the household names in hospitality and transportation. Of these companies, 26 are U.S.-owned, while most of the others are based in Western Europe and East Asia. A few big players aren’t included here because they’re privately held, including Airbnb, Enterprise Car Rental, and Frontier Airlines.

Below we’ve created an infographic to help you understand who owns who.

Embed code:

The seven categories

The companies listed in our top chart are divided into seven of the key categories that make up the travel industry. Five of the brands – the booking sites and ridesharing companies – are tech companies, while the remaining 34 all provide tangible services. Airlines make up half of the companies listed, indicating their dominant role in the travel industry.

Although casinos like MGM and Caesars are also hotels, they’re separated here from non-casino hotels/resorts. At these Las Vegas-style casinos, the accommodation is just one facet of the property, and usually not the biggest earner.

Companies with child brands

Many companies that you might assume to be competitors, or at least separate entities, are actually owned by the same parent company (as shown in the above chart). For example, a casual consumer could probably name a dozen different car rental agencies and would assume they’re all separate businesses. However, most are owned by just three umbrella companies. Avis, Budget, Payless, and Zipcar are all part of Avis Budget Group; Hertz owns both Thrifty and Dollar; and, Enterprise also owns Alamo and National but Enterprise isn’t publicly traded so it didn’t make it on our list.

Booking Holdings sites operate in a similar fashion, and nearly all of them (including Priceline, Kayak, Orbitz, Travelocity, and Airfare Watchdog) are child brands of either Booking Holdings, Expedia, or TripAdvisor. Hotels are much the same; most of the world’s major hotel chains are part of Accor, Marriott, Choice, Hilton, or Intercontinental. If you’ve been to Las Vegas, you might be surprised to know that many of the long-standing casinos on the Strip are actually owned by one company, MGM.

One place where this level of consolidation doesn’t typically happen is the airline industry. While many airlines have subsidiaries that operate their smaller flights to less popular destinations, most of the major airlines are in fact separate companies.

The most and least

profitable travel brands in 2018

Taking the top spot (based on the publicly available 2018 financial reports) was Booking Holdings (BKNG) who narrowly edged out Delta Airlines (DAL). Booking Holdings is the parent company for many popular travel booking sites such as Booking.com, Priceline.com, Agoda.com, Kayak.com, Cheapflights, Rentalcars.com, Momondo, and OpenTable.

The top 10

- Booking Holdings (BKNG)

- Delta Airlines (DAL)

- Carnival Cruises (CCL)

- Southwest Airlines (LUV)

- Las Vegas Sands (LVS)

- Accor (ACCYY)

- Lufthansa Airlines (DLAKY)

- United Continental (UAL)

- Marriott Hotels (MAR)

- Royal Caribbean Cruises (RCL)

The bottom 10

- Uber (UBER)

- Lyft (LYFT)

- Hertz (HTZ)

- TripAdvisor (TRIP)

- Spirit Airlines (SAVE)

- Air Canada (ACDVF)

- Avis (CAR)

- JetBlue (JBLU)

- Choice Hotels (CHH)

- Hawaiian Airlines (HA)

The ten MOST profitable companies span five of the categories included; no car rental or rideshare companies appear in the top ten, due to the issues discussed below. Four of the top ten spots are held by airlines, including three of the U.S.’s primary carriers. While budget airlines are often thought to be the most profitable, Southwest is the only one in the top ten (and it’s the only one of these ten companies to take a big hit in 2018). Despite the hype around tech companies, Booking Holdings is the only one to make the top ten. A sector that seems to be doing better is cruise lines, as two of the big three companies are near the top of the list.

The ten LEAST profitable companies also include four airlines. Two of them are budget carriers, JetBlue (which is “beloved” by consumers) and Spirit (which is often named the “worst airline in America”). Both of the car rental companies and both of the ridesharing companies appear in the bottom ten; the last two spots are held by Lyft and Uber, which lose far more than any other brand. TripAdvisor is also near the bottom, putting three of the five tech companies in the bottom ten. The only hotel company near the bottom is Choice, which operates primarily economy chains, while most of the other hotel brands listed here are more upscale.

Why were some travel brands so

profitable while others were struggling?

A few companies barely moved between 2017 and 2018 (particularly United and Expedia), whereas other brands in the travel sector saw massive change in just one year. With a few exceptions, most of the top companies grew, while most of those at the bottom declined.

Companies that grew

Booking Holdings is the most profitable company listed (only Delta even comes close), and it saw a major increase last year. As travel gets increasingly popular and more properties open up, the company is constantly adding new hotels, apartment rentals, and other accommodations.

The second most profitable company listed here, Delta Airlines, had another of the biggest increases last year. Its approach to different levels of service is one of the factors in the company’s recent growth. Compared to other major U.S. airlines, Delta has focused more on developing premium services, like their Comfort Plus seats, and less on the barebones Basic Economy option.

Two international airlines also made significant leaps last year. Turkish Airlines started 2017 with a fatal accident, so it’s not surprising it would fare much better the following year. The airline has also seen significant growth in its number of passengers. Cathay Pacific, which was in the red in 2017, made a sudden improvement in 2018. This change was likely due to the major transformation the company initiated, which has already included cutting hundreds of jobs and replacing several key executives.

The hotel company that grew the most was Accor, which is the biggest hotel group outside the U.S. and owns chains like Ibis, Novotel, and Fairmont. Its growth has come, in part, thanks to increased demand for hotels in the company’s key regions.

Companies that declined

Southwest is the only company in the top ten to decline substantially, which was likely due in large part to the accident that occurred last April. While most airlines are doing well, both Air Canada and Jet Blue also had major declines last year. Air Canada faced increased competition and higher fuel costs, both of which meant less profit. JetBlue’s costs also went up for another reason: its pilots unionized for the first time, ratifying a contract last summer that raised their pay.

MGM is the only company not in the bottom ten to have declined significantly, which may be due to the mass shooting that took place in Las Vegas in October 2017. MGM is not only the owner of Mandalay Bay, where the shooting took place, but also of many of the other major casinos on the Las Vegas Strip. Months later, the company created a PR nightmare for itself by announcing a lawsuit against the victims of the shooting.

While all businesses in Las Vegas suffered after the shooting, the other casinos listed have fewer properties there and do a greater proportion of their business elsewhere. For example, only about a quarter of properties owned by Caesars, which saw significant growth last year, are in Las Vegas, while over half of MGM’s are there.

Both car rental companies fell substantially last year, but Hertz dropped by twice as much as Avis, taking it into the red. As competition from ridesharing has increased, demand for car rentals has continued to plummet.

Uber and Lyft are the only two companies that were in the red both years, and both lost more in 2018 than 2017. Uber’s massive decline was by far the largest of any company listed.

The challenges faced by TripAdvisor

TripAdvisor is a household name and a site that attracts nearly 500 million visitors every month. Yet, the company has struggled to turn its recognition and traffic into profit.

TripAdvisor’s current revenue model uses two methods: ads and bookings. The latter might come as a surprise, since even avid travelers don’t usually think of it as a booking site. Bookings don’t earn the company a very large commission, either. Though some bookings go straight through TripAdvisor, most route the user to another booking platform, making TripAdvisor a middleman – and reducing its commission. It’s almost as if TripAdvisor wants to function as a meta-search engine like Kayak or Trivago. However, it’s falling short, because it only includes a small number of booking sites and often lists higher prices than are found on the sites otherwise.

A few different types of ads appear on TripAdvisor, including those purchased by businesses to boost their position in the search results or allow them to display more information. A site with as much traffic as TripAdvisor (one would think) could be able to charge a premium for advertising, so the company should have high potential for earning ad revenue.

It’s impossible to know whether TripAdvisor earns more from advertising or bookings, as the company doesn’t report on them separately. It does break down its earnings, however, by hotel and non-hotel (which includes alternative accommodations like apartment rentals, as well as restaurants and tours/attractions). The hotel side makes up almost 80% of its business, but non-hotel business has been growing faster. TripAdvisor owns Viator, the biggest online marketplace of tours and activities, which makes up the bulk of revenue on the non-hotel side.

While TripAdvisor’s struggles seem counterintuitive, the fact that the company climbed out of the red last year suggests it’s already starting to make the right changes.

The struggles of car rental agencies

Though it’s sometimes necessary, renting a car is starting to feel like a relic of the past, which might help explain why car rental agencies are struggling to turn a profit. Even though most have drastically improved their user experience – reducing wait times, providing more options, developing apps – this industry hasn’t been able to shed its reputation for being a hassle.

Renting a car isn’t always economical either. The insurance required for travelers who don’t already own a car can far exceed the cost of the rental. With high fuel prices in many countries, not to mention the cost and scarcity of parking, renting a car doesn’t have much appeal for travelers visiting large cities.

But one of the biggest blows to the car rental industry is the advent of ridesharing, which has now spread to even smaller towns across the U.S. and around the world. Before ridesharing, the cost and inconvenience of taxi services made car rentals the obvious option (outside cities like New York). Now that Uber and Lyft operate almost everywhere at a fraction of the cost, there’s far less need to rent a car.

In addition to the declining demand, car rental agencies also struggle with high operating costs. Rental companies buy new vehicles every year or so, at which point they resell their current cars at low prices. Agencies also get stuck paying high impound and towing fees when customers abandon their vehicles, which happens more often than you would think.

The (not) surprising losses of rideshare companies

Given their widespread recognition, rapid expansion, and constant media attention, you’d be forgiven for assuming that ridesharing giants Uber and Lyft were highly profitable companies. However, both of them are losing money, and a lot of it. As you can see from their places at 38 and 39 here, they operate at a far bigger loss than any of the other brands in travel.

One of the things that makes ridesharing so popular also makes it hard to turn a profit: the extremely low ride prices. When customers are paying just a few dollars for a ride and over half of it goes to the driver, there’s not much profit margin. The millions Uber has had to spend on legal fees and settlements have also been a hit to its bottom line.

The investors who bought into the two companies’ recent IPOs must believe things will turn around. But climbing out of the red would require major changes, by either cutting costs or increasing revenue (or both). One way both companies could reduce costs is by spending less on marketing, driver incentives, and customer rewards, which are likely unnecessary for such well-known companies. Premium options and new services like food delivery could also help offset losses elsewhere if they prove to be successful (which remains to be seen).

But ridesharing companies probably won’t turn a substantial profit unless the price of rides goes up, without causing demand to drop off. Whether Uber and Lyft can become profitable depends on how much more customers are willing to pay for their services.

Why airlines succeed

Traveling by land is a good option if you aren’t going far from home or you’re not too pressed for time. But in other cases, flying is just about the only choice. Since flying is so often a necessity and has few alternatives, it’s no surprise that airlines are generally doing well financially.

Individual airlines also benefit from limited competition, especially in the U.S. There are just a handful of major airlines to begin with, and most direct routes in the U.S. are served by only a couple of them. Faced with little competition, airlines can charge higher prices – earning them more profit. And when it comes to choosing flights, people care almost exclusively about cost, which means airlines can save money by cutting amenities and services without losing customers.

Airlines also profit from all the additional fees tacked onto the base airfare. Especially on budget airlines and domestic routes, passengers pay extra for checked luggage, seat selection, food, in-flight entertainment, and more. Airlines also earn money when passengers shop from their duty-free catalogs, purchase access to their airport lounges, or make a change to their reservation. Plus, they profit handsomely from first and business-class seats and even the “economy plus” options that are becomming more common.

Unlike in most other industries, airlines are able to profit from selling more than they actually have; airlines routinely sell more tickets than there are seats on the plane, which often results in passengers getting bumped. Why? Airlines earn more when they fly full planes, so they sell extra tickets to ensure the plane will be full, even if some passengers don’t show up. If there are too many people for a given flight, the airline can move some of them to less popular routes or times, meaning fewer empty seats on those flights as well.

Airlines’ operating costs – and, therefore, their profitability – is heavily dependent on the cost of fuel. Yet, airlines generally earned more in 2018 than 2017, even though fuel costs went up at the same time. If global oil prices drop, we can expect airlines to do even better.

Our Methodology

We sourced our numbers from Yahoo Finance under the “financials” tab for each popular travel brand. We then took the net income line and divided it by the number of minutes in a year which is 525600.

For example, if you look at Booking Holdings (BKNG) financials you will see that they reported $3,998,000,000 net income for 2018.

$3,998,000,000 / 525600 = $7607 per minute profit.

Please note: Asher & Lyric Fergusson have no position in any of the stocks mentioned except for a trivial stake in LYFT and UBER.